Fraud Risk Management Security Compliance Branch 3892180959 3899622940 3334676388 3496796622 3381483300 3208141024

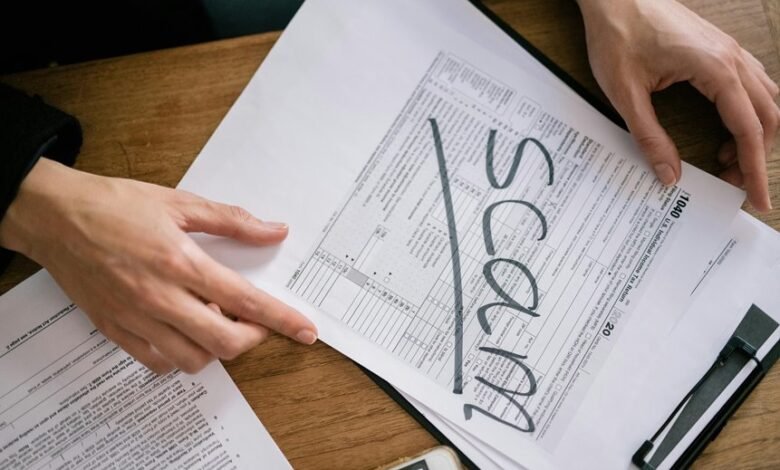

Fraud risk management and security compliance are critical components for Branch 3892180959 and its associated entities. A systematic approach to identifying vulnerabilities can significantly enhance the branch’s defenses against fraudulent activities. Key indicators, such as unusual transaction patterns, require careful monitoring. Furthermore, the implementation of best practices and regular audits fosters a culture of accountability. However, the effectiveness of these measures hinges on the commitment of all stakeholders involved. What challenges lie ahead in sustaining this vigilance?

Understanding Fraud Risk Management

Understanding fraud risk management is essential for organizations aiming to safeguard their assets and maintain compliance with regulatory standards.

Effective fraud detection relies on comprehensive risk assessment methodologies that identify vulnerabilities within systems. By implementing robust controls and monitoring mechanisms, organizations can mitigate potential fraud threats, thereby preserving financial integrity and enhancing operational resilience.

This proactive approach fosters a culture of accountability and transparency.

The Role of Security Compliance

Security compliance plays a critical role in the overarching framework of fraud risk management. It ensures that organizations adhere to regulatory standards, reducing vulnerability to fraud.

Regular security audits identify weaknesses, while compliance training empowers employees with knowledge to recognize and mitigate risks. Together, these practices foster a culture of accountability, enhancing the organization’s resilience against fraudulent activities and promoting freedom through informed decision-making.

Key Identifiers in Fraud Prevention

Effective fraud prevention hinges on the identification of key indicators that signal potential fraudulent activities.

Recognizing fraud indicators such as unusual transaction patterns, discrepancies in documentation, and irregular account behaviors is crucial. These indicators inform targeted prevention strategies, allowing organizations to implement measures that effectively mitigate risks.

A proactive approach in monitoring these signs enhances overall security and protects against financial losses.

Best Practices for Organizations

Identifying key indicators of fraud lays the groundwork for organizations to establish robust defense mechanisms.

Effective employee training is essential, empowering personnel to recognize suspicious activities.

Regular risk assessments should be conducted to identify vulnerabilities, enabling organizations to adapt their strategies proactively.

Conclusion

In conclusion, the proactive measures adopted by Branch 3892180959 serve as a shining beacon of diligence in the realm of fraud risk management. By embracing comprehensive security compliance and fostering an environment of vigilance, the branch deftly navigates potential pitfalls. The careful identification of key indicators, coupled with best practices, ensures a robust framework that not only protects assets but also nurtures a culture of integrity. Ultimately, these efforts create a resilient foundation for sustained operational excellence.